Because the rent payment will be used up in the current period (the month of June) it is considered to be an expense, and Rent Expense is debited. If the payment was made on June 1 for a future month (for example, July) the debit would go to the asset account Prepaid Rent. With a Notes Receivable Account, a promissory note is secured, and the payment is made within one year. The extended repayment timeframe is agreed upon between a business and its customer (debtor) and promissory note helps enforce a business’ legal claim for the debtor’s payment. The amount owed to a seller from a customer is called Accounts Receivable.

Accounts Receivable (Ar)

As hospitals deal with the everchanging financial environment, the billing and collections operation are one of the most crucial aspects of managing a healthcare business. Cash-starved health systems are the victim of a declining AR turnover rate and a deteriorating AR aging schedule. Current liabilities are debts that are paid in 12 months or less, and consist mainly of monthly operating debts. Examples of current liabilities may include accounts payable and customer deposits.

Accounts receivable is an important aspect of a businesses’ fundamental analysis. Accounts receivable is a current asset so it measures a company’s liquidity or ability to cover short-term obligations without additional cash flows. For tax reporting purposes, a general provision for bad debts is not an allowable deduction from profit – a business can only get relief for specific debtors that have gone bad. That means that Company ABC expects to receive $200m that it is owed by customers.

Consider credit terms as 2/10 net 30 i.e. if paid within 10 days, a discount of 2% is offered otherwise payment must be made within 30 days without any discount. To figure out if you are going to be paid, you can look first to your payment history and/or denials from the HMO.

Benefits Of Accounts Receivable

Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a company What is accounts receivable has accumulated. It is often deemed the most illiquid of all current assets – thus, it is excluded from the numerator in the quick ratio calculation.

Most companies operate by allowing a portion of their sales to be on credit. Sometimes, businesses offer this credit to frequent or special customers that receive periodic invoices. The practice allows customers to avoid the hassle of physically making payments as each transaction occurs. In other cases, businesses routinely offer all of their clients the ability to pay after receiving the service. When a company owes debts to its suppliers or other parties, these are accounts payable.

How To Evaluate A Company’s Balance How to Prepare a Bank Reconciliation: 8 Steps Sheet

At the end of each accounting period, the adjusting entry should be made in the general journal to record bad debts expense. Compute the total amount of estimated uncollectible and then make the adjusting entry by debiting the bad debts expense account and crediting allowance for doubtful accounts. The accounts receivable aging method is used to estimate the amount of uncollectable debts which includes the approximate amount of the receivables that may not be collected.

What Factors https://accountingcoaching.online/blog/what-is-the-difference-between-sales-receipts/ Decrease Cash Flow From Operating Activities?

I graduated last fall with a B.Comm in Accounting and I started a accounts payables job following my degree. I didn’t network as much or study too hard in University, nor did I try to get offers from public accounting firms (I was young and stupid I guess). The aging schedule also identifies any recent changes and spot problems in accounts receivable. This can provide the necessary answers to protect your business from cash flow problems. If your clients haven’t paid, one possible reason is that they do not have the funds to do so.

Accounts Receivable Job Description Guide

- When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry.

- Account receivables are classified as current assets assuming that they are due within one calendar year or fiscal year.

- To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account.

What is difference between accounts payable and accounts receivable?

Accounts Receivable and Accounts Payable: What’s the Difference? Accounts payable (AP) is considered a liability to a company. It is the amount of money a company owes because on credit it purchased good and services from a vendor. Accounts receivable (AR) is considered an asset to a company.

Like revenue accounts, expense accounts are temporary accounts that collect data for one accounting period and are reset to zero at the beginning of the next accounting period. Income accounts are temporary or nominal accounts because their balance is reset to zero at the beginner of each new accounting period, usually a fiscal year. If the Cash basis accounting method is used, the revenue is not realized until the invoice is paid. Equity is of utmost importance to the business owner because it is the owner’s financial share of the company – or that portion of the total assets of the company that the owner fully owns.

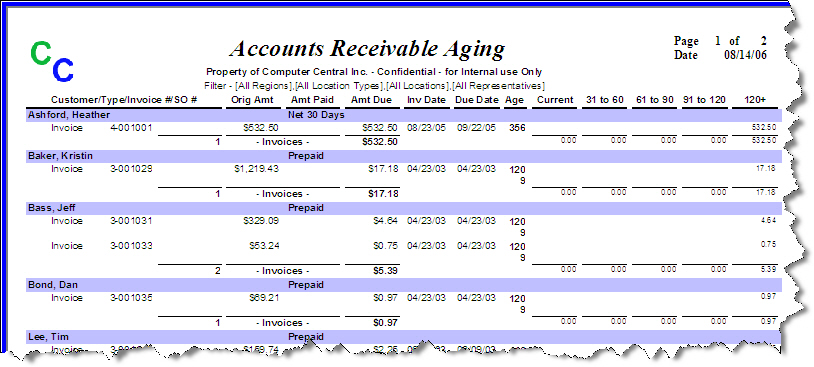

If the receivable amount only converts to cash in more than one year, it is instead recorded as a long-term asset on the balance sheet (possibly as a note receivable). An accounts receivable aging is also known as a schedule of accounts receivable. A variation is that this schedule may contain a simple listing of receivables by customer, rather than breaking them down further by age.

If there is a precipitous decline due to the closed office/fewer services being billed, then you can adjust the baseline you use, shortening it to say three months instead of six, for instance. For instance, if you have charged $280,000 in the past six months, and if there were 182 days in those months, your average daily revenue is $1,538. Then, if your total accounts receivable is $70,000, the Days in Accounts Receivable is 45.5. Since cash was paid out, the asset account Cash is credited and another account needs to be debited.

While at least some experience is demanded by most employers, on-the-job training is also a very common practice. Most employers ask for at least some experience working in accounting before even considering someone for the accounts receivable job. The most common experience requirement is for the aspiring employee to already have worked one to three years as an accounts receivable. Since the accounts receivable job description can be very stressful at times, not many people can handle the responsibilities without a certain number of skills and personal qualities. These can range from skills picked up in grade school to talents that have always been with the interested employee.

The aging schedule is used to identify clients that are late in paying their invoices. If the bulk of the overdue amount is attributable to a single client, the business can take necessary steps to ensure What is accounts receivable that the customer’s account is collected promptly. In this report, you’ll find a list of every contact with the total amount due at the bottom, organized by the amount of days the amount has been due.

Normal Balances

Having one of the most stressful jobs in finance, account receivables have to be ready to communicate with clients and superiors all day long. They handle huge sums of money every single day, so responsibility and math skills are a must for the accounts receivable job description. Still, with an estimated median salary of $36,122 per year, the job outlook for the position is What is accounts receivable fairly optimistic. But even if one does not want to keep on doing their job as an accounts receivable clerk, they can easily switch to different, better paid and better-regarded positions in the company. These positions include accounts receivable coordinator job description, the accounts receivable manager job description, or something even higher up in the organization.

What is the role of accounts receivable?

The key role of an employee who works as an Accounts Receivable is to ensure their company receives payments for goods and services, and records these transactions accordingly. An Accounts Receivable job description will include https://accountingcoaching.online/ securing revenue by verifying and posting receipts, and resolving any discrepancies.