Customer Refunds Payable is an account used to record merchandise returns from customers. The purpose of adjusting entries is to accurately assign revenues and expenses to the accounting period in which they occurred.

Someone other than the cashier should compare this receipt to the amount on the deposit slip and reconcile any differences. It may be useful to staple the receipt to a copy of the deposit slip and file the documents, as proof that the matching step was completed. Save money and don’t sacrifice features you need for your business. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

The general journal shows all journal entries for anything not recorded in any of the journals above. The purchases journal is used to record all purchases of inventory on credit.

It requires the business to allocate recourses to gaining reliable internet access, designing a website, and setting up email facilities, organising security measures and ongoing maintenance. Kermit has a shop in the Yeppoon business area that sells lily pads. He feels his business is limited in Yeppoon and want to sell to the world vial the internet. He has asked you for advice on how to set up his business on the net. Password protection can be implemented to protect unwanted access.

Here’s a list of similar words from our thesaurus that you can use instead. Further , on Purchases of Furniture in Cash , there is a in reduction the cash receipts journal will be used for of Cash, which is an Asset. When an asset is reduced, the asset account is credited according to the Rules of Debit and Credit.

Nearby Words Of

Cash Receipt

Manual systems usually had a variety of journals such as a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and a general journal. Depending on the business’s accounting information system, specialized journals may be https://simple-accounting.org/ used in conjunction with the general journal for record-keeping. In such case, use of the general journal may be limited to non-routine and adjusting entries. If a company issues loans, the cash receipts from loan payments aren’t necessarily revenue.

For example, a customer buys $2,000 of merchandise with a $500 cash payment and uses store credit for the remaining $1,500. You make a $500 debit entry in the cash receipts journal, a $1,500 debit entry in the customer’s accounts receivable account and a $2,000 credit entry to sales. Modify your journal entry slightly if the customer takes advantage of a cash discount.

What is the limit for cash transaction?

Section 269ST: Restrictions on Cash Transactions

The section states that no person shall receive an amount of INR 2 Lakhs or more in CASH in aggregate from a single person in a day: in respect of a single transaction or in respect of transactions relating to one event or occasion from a person.

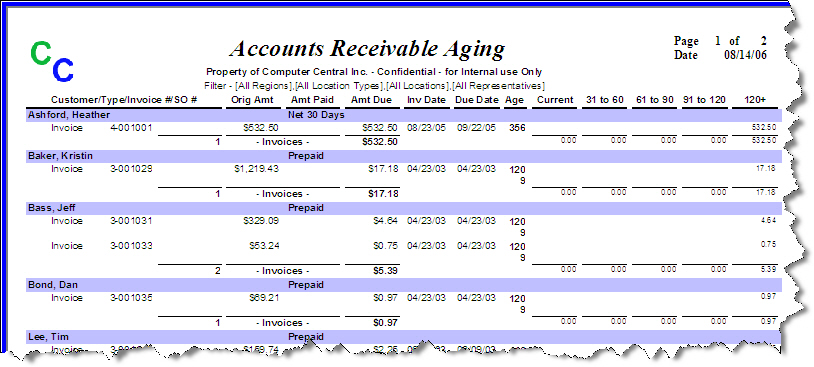

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a BSc from Loughborough University. The total of all the subsidiary ledger balances should be equal to the balance on the subsidiary ledger control account in the general ledger.

Purchases Returns Journal (Prj)

Uninterruptible power supply or UPS is a back up of power to a business so important files that are unsaved wont be lost. The business can implement virus protection for unwanted viruses.

- The cash receipts journal is a chronological record of your cash transactions.

- Compare the bank receipt amount to the deposit slip amount to verify both amounts are the same.

- You should receive a bank receipt every time you make a deposit.

- Staple the bank receipt to your copy of the deposit slip and keep it as a record of your sale and deposit.

- Before making the deposit, verify that the deposit slip amount and the cash receipts journal amount is the same.

- The sales receipt contains the information you need to enter the transaction into your cash receipts journal.

Business

Petty cash is simply a sum of cash on hand kept to pay small expenses. This is the key information that should include in the format of the journal, and there may be a difference in format depending on the entity’s management decision. A physical inventory should be taken at the end of every month. is aproof ofpurchase issued when thebuyer has paid in cash.

Once again the “bank” column is added up to show the total payments. The “bank” column is added up to show the total cash received for the period concerned. Note that major categories of receipts, such as from income the cash receipts journal will be used for ordebtors, receive their own column. journal entries but is also the term used for thebooks of first entry. Additional information that should include is a reference and more importantly is debit and credit.

It originally bought the machine for $20,400 three years ago and has taken $8,000 depreciation. Moab Inc. manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision, it has entered into several transactions during the year. Webtrust is a seal on any website that assures the world that the site conforms to international standards of e-commerce best practice.

The purchases returns journal shows all returns of inventory that were originally purchased on credit. This journal is used specifically for transactions where goods that were originally sold have now been returned. Expenses are increased in debit so when we record in the journal, we need to debit the amount. the cash receipts journal will be used for The first entries for this example are related to cash transactions that shareholder inject into the entity for investment capital. In the detail of the journal, key information that should be included is a line of the journal, date of the transactions, name of account and description of transactions.

Compare the total on the deposit slip to the amount stated on the mailroom check receipts list, and reconcile any differences. Then store the the cash receipts journal will be used for checks and cash in a locked pouch and transport it to the bank. Keep in mind, the cash receipt process varies from business to business.

When specialized journals are used, the general journal is not necessary. is a proof of purchase issued when the buyer has paid in cash. are the printed documents which are issued each and every time cash is received for a specific service or good.

Cash Receipts Journal Totals Used To Update The General Ledger

Cash, checks, debit cards, credit cards and wire transfers are treated as cash sales. When your customer pays for a purchase in cash or with a check, the sale is complete. You do not have the cash receipts journal will be used for to bill your customer or worry about collecting overdue amounts. If you extend store credit, your customer may drop off a cash payment or send in a check to pay the invoice amount.

What Is Another Word For Receipt?

Post the entire amount of the invoice to the receivables account as a credit, reducing the receivable. Post the actual amount received to the cash account as a debit, reflecting the physical payment deposited into the bank.

What are the three phases of setting up an accounting system?

[Solved] The three phases of setting up an accounting system are, in order a. design, implementation, analysis b.