Content

Management also uses these reports to determine the financial stability of the company by examining the profit or loss positions for the period. The cash flow that comes into the company is known as cash receipts. This process involves receiving and recording the cash payments from customers for services rendered or products sold. Accounts QuickBooks receivable is responsible for ensuring the customer receives an invoice for the goods or services and that the customer pays the balance due on that invoice. For discharging his responsibilities, he keeps accurate accounts of all financial transactions of his business, and these are regarded as stewardship functions of accounting.

First, gather all types of earnings during the time period the statement will cover. These sources of earnings could be wholesale and retail sales or income from renting adjusting entries out propriety. Next total up all of your expenses such money spent on materials, payroll, advertising, utilities, equipment and rent on business properties.

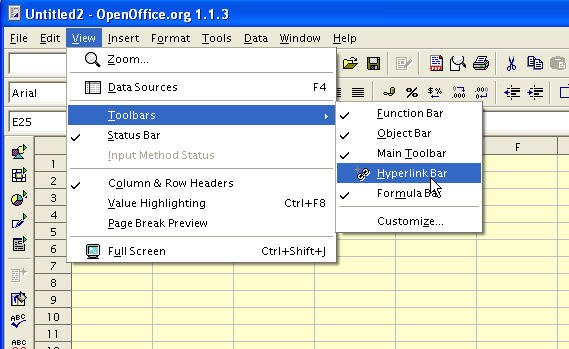

Accounting information systems involves the development, installation, implementation, and monitoring of accounting procedures and systems used in the accounting process. It includes the employment of business forms, accounting personnel direction, and software management. External auditing refers to the examination of financial statements by an independent party with the purpose of expressing an opinion as to fairness of presentation and compliance with GAAP. Cost accountants also analyze actual costs versus budgets or standards to help determine future courses of action regarding the company’s cost management. Often times considered as a subset of management accounting, cost accounting refers to the recording, presentation, and analysis of manufacturing costs.

In cost accounting, classification is basically on the basis of functions, activities, products, process and on internal planning and control and information needs of the organization. Finance is a broad term that describes activities associated with banking, leverage or debt, credit, capital what are retained earnings markets, money, and investments. Basically, finance represents money management and the process of acquiring needed funds. Finance also encompasses the oversight, creation, and study of money, banking, credit, investments, assets, and liabilities that make up financial systems.

A fraudster can hack into autoloading gift cards and drain a customer’s bank account by buying new, physical gift cards through the autoloading gift card account. This is a real problem, and an internal control to reduce this type of fraud is to use a double verification system for the transfer of money from a bank account to reloadable gift card account. Accountants can help their organization limit gift card fraud by reviewing their company’s internal controls over the gift card process. Management and cost accounting are apparatus used to help management make decisions on a day to day basis.

Cash Flow Statements

The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. A balance shows the assets, liabilities and shareholder equity during a specific period. On the right side of the page list your liabilities including accounts payable, credit card balances, bank loans and any other money your company owes. Finally, total your assets and liabilities and then subtract your liabilities from your assets.

You base your cash flow statement partly on your sales forecasts, balance sheet items and other assumptions. Existing business should have historical financial statements to use to project their cash flow. New businesses should start by projecting cash flow statement that is broken down into 12 months. To get these projections is important to know how you will be invoicing.

What All Types Of Accounting Have In Common

- Investors can also see how well a company’s management is controlling expenses to determine whether a company’s efforts in reducing the cost of sales might boost profits over time.

- However, it can be very effective in showing whether sales or revenue is increasing when compared over multiple periods.

- The trial balance, which is usually prepared using the double-entry accounting system, forms the basis for preparing the financial statements.

- All the figures in the trial balance are rearranged to prepare a profit & loss statement and balance sheet.

This information is generally internal and is primarily used by management to make decisions. Other sectors of the accounting field include cost accounting, tax accounting, and auditing. The cash flow statement reconciles the income statement with the balance sheet in three major business activities.

Analyze Cash Flow The Easy Way

To illustrate double-entry accounting, imagine a business sends an invoice to one of its clients. An accountant using the double-entry method records a debit to accounts receivables, which flows through to the balance sheet, and a credit to sales revenue, which flows through to the income statement. In most cases, accountants use generally accepted accounting principles when preparing financial statements in the U.S. GAAP is a set of standards and principles designed to improve the comparability and consistency of financial reporting across industries.

Cash flow from financing activities is a section of a company’s cash flow statement, which shows the net flows of cash used to fund the company. Although financial statements provide a wealth of information on a company, they do have limitations. The statements are open to interpretation, and as a result, investors often draw vastly different conclusions about a company’s financial performance. Investing activities include any sources and uses of cash from a company’s investments into the long-term future of the company. A purchase or sale of an asset, loans made to vendors or received from customers or any payments related to a merger or acquisition is included in this category.

For example, you might have a monthly accounting period while another company has a quarterly period. Multiple people might want to analyze your business’s cash flow, such as investors, lenders, and vendors. Your cash flow statement helps determine where your business’s cash flow stands and your company’s overall financial health. The finances section of your cash flow statement shows how much money is flowing in and out of your business because of loans, dividends, or debts.

How To Make A Financial Statement For Small Business

The income statement reports a company’s profitability during a specified period of time. The period of time could be one year, one month, three months, 13 weeks, or any other time interval chosen by the company. These requirements mandate an annual report to stockholders as well as an annual report to the SEC. The annual report to the SEC requires that independent certified public accountants audit a company’s financial statements, thus giving assurance that the company has followed GAAP. If http://barnana.jp/what-is-income-summary/ is going to be useful, a company’s reports need to be credible, easy to understand, and comparable to those of other companies.

For example, although a magazine publisher receives a $24 check from a customer for an annual subscription, the publisher reports as revenue a monthly amount of $2 (one-twelfth of the annual subscription amount). In the same way, it reports its property tax expense each month as one-twelfth of the annual property tax bill. Financial services are the processes by which consumers and businesses acquire financial goods. One straightforward example is the financial service offered by a payment system provider when it accepts and transfers funds between payers and recipients.

An accountant may also be responsible for ensuring that all financial reporting deadlines are met, internally and externally. https://simple-accounting.org/ For example, quarterly, semi-annual and annual reports all have specific deadlines, as well as some tax implications.

What are the 8 branches of accounting?

The famous branches or types of accounting include: financial accounting, managerial accounting, cost accounting, auditing, taxation, AIS, fiduciary, and forensic accounting.

From an economic perspective, financial accounting treats money as a factor of production. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.

Investing activities generated negative cash flow or cash outflows of -$10,862 for the period. Additions to property, plant, and equipment made up the majority of cash outflows, which means the company invested in new fixed assets.

Managerial accounting focuses on operational reporting to be shared within a company. A cash flow statement is financial accounting a financial statement that provides aggregate data regarding all cash inflows and outflows a company receives.