How Much Can I Receive From My Social Security Retirement Benefit?

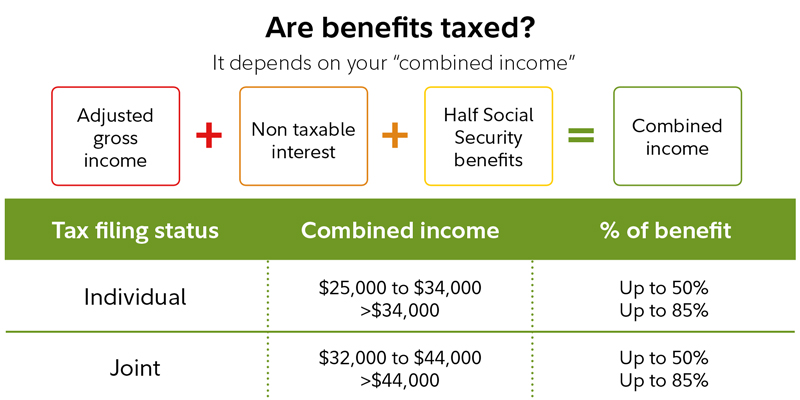

If you delay collecting Social Security past your full retirement age, you can collect more than your full, or normal, payout. In fact, if you put off claiming until age 70, you will receive a 32% higher annual payout than if you started receiving benefits at full retirement. The tax laws encourage retired people to “live in sin”—that is, without Social Security Retirement Benefit benefit of marriage. A couple increases the amount of income they can earn without being taxed on their Social Security benefits if they aren’t married and file their taxes separately. Each will be entitled to earn $25,000 in combined income without paying tax on their benefits, for a total of $50,000 of income without extra taxes.

What The Minimum Benefit Should Be To Keep Retirees Out Of Poverty

In contrast, a married couple can earn no more than $34,000 in combined income without paying extra taxes. However, a married couple can get the same treatment as singles if they live apart part of the year and file https://business-accounting.net/ their taxes separately. If Colleen waits until age 66 and 6 months to collect, she will receive approximately $2,000 a month. However, if she begins taking benefits at age 62, she’ll only receive $1,450 a month.

This makes it easy to see how changes in the date or age at which you begin receiving retirement benefits will affect your future income. Once you file for your benefits, you’re stuck with your paycheck, though annual cost of living adjustments may push the monthly benefit higher. However, you do have 12 months from when you file to withdraw from the program, but you’ll have to return any money you’ve received.

Withholding Income Tax From Your Social Security Benefits

This “early retirement” penalty is permanent and results in her receiving up to 28% less year after year. If you start taking Social Security at age 62, rather than waiting until your full retirement age , you can expect up to a 30% reduction in monthly benefits with lesser reductions as you approach FRA. So if you begin Social Security at 62, and start with reduced benefits, your COLA-adjusted benefit will be lower too.

While the full retirement age used to be 65, changes to the program have increased that age. For example, those born in 1955 now have to wait an extra two months beyond age 66 to claim their full benefit. Someone born in 1959, for example would have to wait until age 66 and 10 months to get the full benefit.

Learn More:

You can find your full retirement age by birth year in the full retirement age chart. Choosing when to start receiving retirement benefits is a personal decision. If you choose to retire begin receiving benefits when you reach your full retirement Social Security Retirement Benefit age, you’ll receive your full benefit amount. We will reduce your benefit amount if you retire start benefits before reaching full retirement age. allows you to get personalized retirement benefits estimates based on your actual earnings.

- In 2019, the maximum monthly Social Security benefit for a worker retiring at full retirement age was $2,861.

- If that same individual waits to get benefits until age 70, the monthly benefit increases to $1,266.

- The flip side is that as the taxable maximum income increases, so does the maximum amount of earnings used by the SSA to calculate retirement benefits.

The Best Age To Start Collecting

As long as you continue to work, your PIA will change, up to age 70. Your benefit will be permanently reduced if you take Social Security Retirement Benefit it early, which could be as soon as age 62, or increased if you put off taking it, but again, increases stop at age 70.

If she started receiving retirement benefits before her full retirement age, the benefit paid is based on a combination of her work record and your work record, and is reduced because she received https://business-accounting.net/what-is-the-maximum-i-can-receive-from-my-social/ benefits early. If your earnings this year surpassed one of the years that went into computing your retirement benefit, the Social Security Administration will recalculate your benefit amount.

How much Social Security will I get if I retire at 63?

Following the recommendation on the Social Security website, you file online three months before you want your benefit to start, that is, on or before May 10th. Again, no matter what the actual “date” of your birth is, your benefit can begin in August.

If you wait until after your full retirement age to claim Social Security retirement benefits, your benefit amounts will be permanently higher. Your benefit amount is increased by a certain percentage each year you wait up to age 70.

In this example, that higher the amount at age 70 is about 76% more than the benefit they would receive each month if benefits started at age 62, or a difference of $550 each month. Say that someone who turns 62 in 2020 will reach full retirement age at 66 years and eight months, with earnings that make them eligible at that point for a monthly benefit of $1,000. Opting to receive benefits at age 62 will reduce their monthly benefit by 28.4% to $716 to account for the longer time they could receive benefits, according to the Social Security Administration. Note that if your benefits are withheld, at least some of those benefits will be returned to you in the form of higher monthly benefits once you reach full retirement age.

The Social Security a worker is entitled to if they claim benefits at full retirement age is known as the primary insurance amount, or PIA. This is calculated as an average of the worker’s 35 highest inflation-adjusted years of earnings, applied to a benefit formula that is modified annually. Social Security Retirement Benefit The benefit calculated under this income replacement formula is called the Primary Insurance Amount (or “PIA” for short), and represents the benefit the retiree would get at full retirement age. If claimed at her full retirement age, it is half of your full retirement age benefit.

Full retirement age is the age when you will be able to collect your full retirement benefit amount. The full retirement age increases gradually if you were born from 1955 to 1960, until it reaches 67. For anyone born 1960 or later, full retirement benefits are payable at age 67.

Social Security Resource Center

For every $3 you earn over the 2020 limit, your Social Security benefits will be reduced by $1, but that will only apply to money earned in the months prior to hitting full retirement age. Once you reach full retirement age, no benefits will be withheld if you continue working. The absolute earliest you can start claiming Social Security retirement benefits is age 62.