Remember you can pay off, for example, a 30-year mortgage in 15 years by paying it like a 15-year mortgage. This method can help you avoid the stress of having to make a higher monthly payment while enabling the option of paying off the loan faster. Unamortized loans, on the other hand, are attractive to borrowers because of their interest-only Amortization schedule payments, which tend to be lower than amortized loan payments of combined principal and interest. The monthly payments for unamortized loans are also easier to calculate since you only have to worry about the interest. These lower, interest-only payments allow borrowers of unamortized loans to save up enough to make a large lump sum payment.

Why Does It Take So Long To Pay Down My Principal?

The mortgage-style amortization also has its shortcomings; borrowers pay the bulk of the interest up front, and it takes a longer time to reduce principal balances. There are many ways that you can use the information in a loan https://simple-accounting.org/. Knowing the total amount of interest you’ll pay over the lifetime of a loan is a good incentive to get you to make principal payments early. When you make extra payments that reduce outstanding principal, they also reduce the amount of future payments that have to go toward interest. That’s why just a small additional amount paid can have such a huge difference.

More Amortization Info

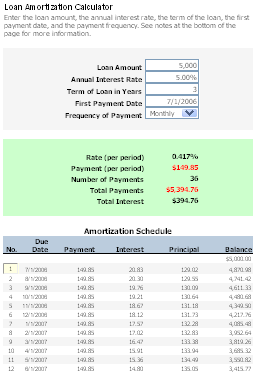

An https://simple-accounting.org/amortization-schedule-accountingtools/ can be created for a fixed-term loan; all that is needed is the loan’s term, interest rate and dollar amount of the loan, and a complete schedule of payments can be created. This is very straightforward for a fixed-term, fixed-rate mortgage. Amortization is the process of paying off a debt with a known repayment term in regular installments over time.

Both methods allow for more of a tax shield in the beginning of the loan because the borrower initially pays a higher amount of interest. Check out our shortlist of the best personal loans for debt consolidation and cut your monthly payment with a lower rate. The loan term refers to the fixed duration of time you must pay your lender. The length of your loan dictates the number of payments you need to make to pay your debt.

While bullet loans serve vital functions for borrowers short on cash, they lead to problems when managed improperly. In many cases, balloon amounts are refinanced into conventional amortizing loans as they come due, spreading the payments out further.

At the beginning of the loan, interest costs are at their highest. As time goes on, more and more of each payment goes towards your principal and you pay proportionately less in interest each month. How different terms, like a 30-year versus a 15-year, compare in monthly payments and interest paid over the life of the loan. Your amortization schedule will show you how much of your monthly mortgage payments you spend toward principal and interest. Say you are taking out a mortgage for $275,000 at 4.875% interest for 30 years (360 payments, made monthly).

The interest rate is then applied to this new principal balance, and because the balance is lower, the amount of interest will also be lower. This is why the interest and principal in an amortization schedule have an inverse relationship.

Where Will Mortgage Rates Head Next Week?

As final amortized payments near, borrowers are not subject to balloon payments or other irregularities. Instead, the original purchase price of the asset continues to amortize until it is completely Amortization schedule paid-off. This calculator will compute a loan’s payment amount at various payment intervals — based on the principal amount borrowed, the length of the loan and the annual interest rate.

Your Loan Payments

Is amortization always straight line?

The change in principal and interest is detailed in an amortization schedule. The amount applied to interest will generally be greater towards the beginning of the repayment period and will decrease as time goes on.

Mortgages, with fixed repayment terms of up to 30 years (sometimes more) are fully-amortizing loans, even if they have adjustable rates. Revolving loans (such as those for credit cards) don’t have a fixed repayment term, are considered are open-ended debt and so don’t actually amortize, even though they may be paid off over time. Basic amortization schedules do not account for extra payments, but this doesn’t mean that borrowers can’t pay extra towards their loans. Also, amortization schedules generally do not consider fees.

The percentage of every payment that is paid toward interest continually decreases, while the percentage of each payment that goes toward the principal of the loan continually increases. This means the balance of the principal of your loan will not decrease much in the earlier part of your repayment schedule. Sometimes it’s helpful toseethe numbers instead of reading about the process. The table below is known asan amortization table(or amortizationschedule) and demonstrates how each payment affects the loan, how much you pay in interest, and how much you owe on the loan at any given time. This Amortization schedule is for the beginning and end of an auto loan.

Even with lower monthly payments, longer debt incurs more interest charges. This is especially inequitable if you take longer to pay down a new car. If you take a 6 or 7-year term, you’ll end up spending more for a car with less value. Lenders create anamortization schedulewhich breaks down every loan payment you make. This is a table which indicates exactly how much of your monthly payment goes toward your interest and principal balance.

This loan calculator – also known as an amortization schedule calculator – lets you estimate your monthly loan repayments. It also determines out how much of your repayments will go towards the principal and how much will go towards interest. Simply input your loan amount, interest rate, loan term and repayment start date then click “Calculate”. What happens is that you pay the interest accumulated on that principal during the period.

This is a $20,000 five-year loan charging 5% interest (with monthly payments). Your last loan payment will pay off the final amount remaining on your debt. For example, after exactly 30 years (or 360 monthly payments) you’ll pay off a 30-year mortgage. Amortization tables help you understand how a loan works, and they can help you predict your outstanding balance or interest cost at any point in the future.

Credit cards provide revolving credit that also operate with interest and principal balance. Amortization schedule It is technically not an amortizing loan because the amount you borrow is not fixed.

Types Of Amortizing Loans

Then, once you have computed the payment, click on the “Create Amortization Schedule” button to create a chart you can print out. A loan payment schedule usually shows all payments and interest rounded to the nearest cent.

Compare A 30-year Loan

You can keep paying it for years because there is no imposed loan term. However, to reduce your debt faster, you can also make principal payments or higher fixed payments on your credit card. Misguided borrowers think that extended loan terms with low monthly payments make a favorable deal.

Calculate Your Interest Charge

Amortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. With mortgage amortization, the amount going toward principal starts out small, and gradually grows larger month by month. Meanwhile, the amount going toward interest declines month by month for fixed-rate loans.